michigan sales tax exemption for manufacturing

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Fishing hunting construction finance and insurance information publishing and communications manufacturing.

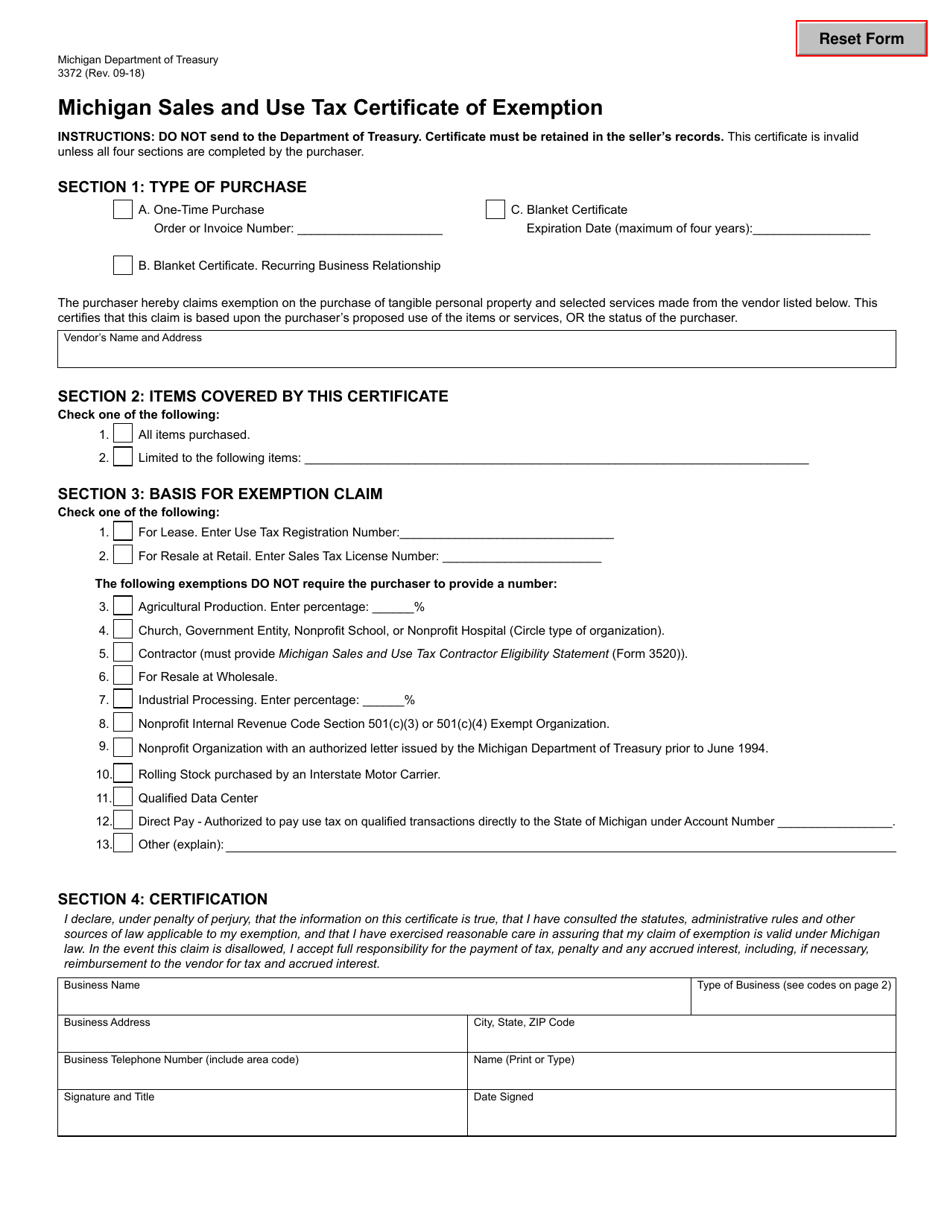

This exemption claim should be completed by the purchaser provided to the seller and is not valid unless the information in all four sections.

. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt. 01-21 Michigan Sales and Use Tax Certificate of Exemption. All claims are subject to audit.

To claim the Wisconsin sales tax exemption for manufacturing qualifying manufacturers need to complete Wisconsin Form S-211 which is a Wisconsin Sales and Use Tax Exemption Certificate and provide a copy of this certificate to their vendorsWisconsin has made it easy for qualifying manufacturers to complete the S-211 exemption certificate by providing. Tax-exemption applied to nonprofits means that in most cases the sales tax for certain sales is waived for transactions relating to the charitys charitable mission In some states exemption from paying sales tax depends on the nature and volume of the sales activities by the non-profit. Small Business Taxpayer Exemption Eligible Manufacturing Personal Property and Act 328 New Personal Property.

The Indiana sales tax exemptions for manufacturing are available to all Indiana manufacturers on purchases of manufacturing machinery tools and equipment that are directly used in production manufacture fabrication assembly extraction mining processing refining or finishing of tangible personal property per Indiana Admin. The Streamlined Sales Tax Agreement Certificate of Exemption should be utilized when the business which is doing the purchasing can be identified as one of the following. The General Property Tax Act provides for exemptions for certain categories of personal property including.

This link will provide information on each of these exemptions including determining eligibility and how to claim the. Accommodation and food services agricultural forestry. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Michigan Department of Treasury 3372 Rev.

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller